Leave a Legacy to Hospice of Marion County

Leave a Legacy to Hospice of Marion County

Endowment

When you include Hospice of Marion County Inc in your

will/trust or as a beneficiary of a retirement plan or life insurance

policy, Hospice of Marion County Inc will invest the funds in the endowment

with other previous gifts.  A

team of investment professionals manages the entire endowment. Each year,

Hospice receives a distribution of approximately 5% of the value

of the fund. If the endowment earns an average of 8%, the additional 3%

remains in the fund; thus your original gift will increase

over time.

A

team of investment professionals manages the entire endowment. Each year,

Hospice receives a distribution of approximately 5% of the value

of the fund. If the endowment earns an average of 8%, the additional 3%

remains in the fund; thus your original gift will increase

over time.

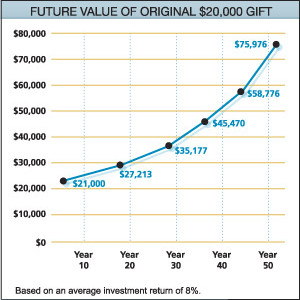

The chart on the left illustrates the growth of the annual distributions of an endowment gift under these assumptions. The 3% net growth in the fund each year means the following year there is a greater amount available to Hospice. Looking at the chart, you can see that in the tenth year the fund has grown to the point where it is able to provide $1,361 annually. Each year it will continue to grow. In year 50 it will be able to provide $3,799 dollars to support our work.

All

told, over the fifty years we have charted, your endowment gift of $20,000

will have distributed a total of $108,367 in annual distributions to Hospice and have grown to almost $76,000, continuing to provide needed

support. Of course, this is based on the assumptions we outlined in the

opening paragraph; that the fund grows at 8% each year and pays out 5%

leaving 3% additional in the fund each year.

All

told, over the fifty years we have charted, your endowment gift of $20,000

will have distributed a total of $108,367 in annual distributions to Hospice and have grown to almost $76,000, continuing to provide needed

support. Of course, this is based on the assumptions we outlined in the

opening paragraph; that the fund grows at 8% each year and pays out 5%

leaving 3% additional in the fund each year.

Your original gift is never depleted; it provides annual support each year into the future.

The chart on the right illustrates how a gift of $20,000 to the endowment will grow, providing greater annual distributions to Hospice. The illustration assumes the same average investment rate of return of 8%, which is not a guarantee, and annual distribution to Hospice of approximately 5% that we used above.

If you are considering a tax-wise planned gift or changes to your will or trust to include a bequest, we would be delighted to answer any questions or help in any way. Call (352) 873-7400 ext 1771 for a confidential discussion to see how Hospice can fit into your estate planning. You may also email the Planned Giving Director, Beth McCall, CFRE.

Please note, individual financial circumstances will vary. The information on this site does not constitute legal or tax advice, either in whole or in part. Donor stories and photographs are for purposes of illustration only. As with all tax and estate planning, please consult your attorney or estate specialist. All material is copyrighted and is for viewing purposes only. Use of this site signifies your agreement with the terms of use. The content in this Legacy Giving section has been developed for Hospice of Marion County by Future Focus.

Disclaimer registration #: CH1781

A copy of the official registration and financial information may be obtained from the Division of Consumer Services by calling toll-free 1-800-435-7352 within the state or at www.FloridaConsumerHelp.com Registration does not imply endorsement, approval or recommendation by the State.

Hospice of Marion County

3231 SW 34th Avenue

Ocala, FL 34474

Main number: 352-873-7400

Admissions: 352-873-7415

Compliance Hotline: 844-854-5102

Notice of Nondiscrimination | Español | Kreyòl Ayisyen | Tiếng Việt | Português | 繁體中文 | Français | Tagalog | Русский | Italiano | Deutsch | 한국어 | Polski | ગુજરાતી | ภาษาไทย

Free language assistance services are available at 352-873-7400. Florida Relay Services allows hearing or speaking impaired persons to communicate by telephone 24 hours a day. Call 800-676-3777 (English) or 800-676-4290 (En Español).

Copyright © 2020 Hospice of Marion County • All Rights Reserved