Endowment

When you include Florida State University Foundation in your

will/trust or as a beneficiary of a retirement plan or life insurance

policy, Florida State University Foundation will invest the funds in the endowment

with other previous gifts.  A

team of investment professionals manages the entire endowment. Each year,

WFSU receives a distribution of approximately 5% of the value

of the fund. If the endowment earns an average of 8%, the additional 3%

remains in the fund; thus your original gift will increase

over time.

A

team of investment professionals manages the entire endowment. Each year,

WFSU receives a distribution of approximately 5% of the value

of the fund. If the endowment earns an average of 8%, the additional 3%

remains in the fund; thus your original gift will increase

over time.

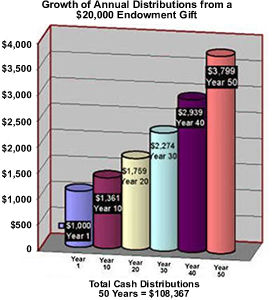

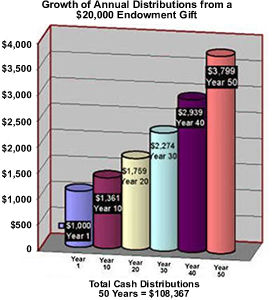

The chart on the left illustrates the growth

of the annual distributions of an endowment gift under these

assumptions. The 3% net growth in the fund each year means the following

year there is a greater amount available to WFSU. Looking at

the chart, you can see that in the tenth year the fund has grown to the

point where it is able to provide $1,361 annually. Each year it will

continue to grow. In year 50 it will be able to provide $3,799 dollars

to support our work.

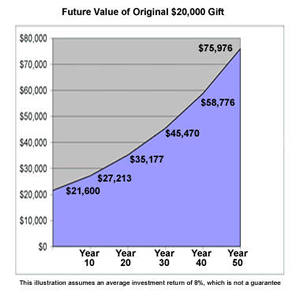

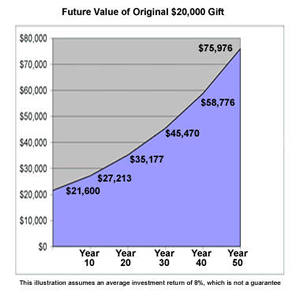

All

told, over the fifty years we have charted, your endowment gift of $20,000

will have distributed a total of $108,367 in annual distributions to WFSU and have grown to almost $76,000, continuing to provide needed

support. Of course, this is based on the assumptions we outlined in the

opening paragraph; that the fund grows at 8% each year and pays out 5%

leaving 3% additional in the fund each year.

All

told, over the fifty years we have charted, your endowment gift of $20,000

will have distributed a total of $108,367 in annual distributions to WFSU and have grown to almost $76,000, continuing to provide needed

support. Of course, this is based on the assumptions we outlined in the

opening paragraph; that the fund grows at 8% each year and pays out 5%

leaving 3% additional in the fund each year.

Your original gift is never depleted; it provides

annual support each year into the future.

The chart on the right illustrates how a gift

of $20,000 to the endowment will grow, providing greater

annual distributions to WFSU. The illustration assumes the

same average investment rate of return of 8%, which is not a guarantee,

and annual distribution to WFSU of approximately 5% that we

used above.

Return

to Bequests.

Please note that we use pop-up windows

for some of our links to provide a printable page. If you have pop-ups blocked,

holding down the CTRL key (or sometimes the SHIFT key) while clicking on these

linkswill often allow the pages to open without having to disable pop-up blocking

on your computer.

Important note, individual financial

circumstances will vary. The information on this site does not constitute legal

or tax advice. Donor stories and photographs are for purposes of illustration

only. As with all tax and estate planning, please consult your attorney or estate

specialist. All material is copyrighted and is for viewing purposes only. Use

of this site signifies your agreement with the terms

of use. The content in this Planned Giving section has been developed for

WFSU by Future Focus. Please report

any problems to section

webmaster. Revised: July 21, 2016 22:27.

A

team of investment professionals manages the entire endowment. Each year,

WFSU receives a distribution of approximately 5% of the value

of the fund. If the endowment earns an average of 8%, the additional 3%

remains in the fund; thus your original gift will increase

over time.

A

team of investment professionals manages the entire endowment. Each year,

WFSU receives a distribution of approximately 5% of the value

of the fund. If the endowment earns an average of 8%, the additional 3%

remains in the fund; thus your original gift will increase

over time. All

told, over the fifty years we have charted, your endowment gift of $20,000

will have distributed a total of $108,367 in annual distributions to WFSU and have grown to almost $76,000, continuing to provide needed

support. Of course, this is based on the assumptions we outlined in the

opening paragraph; that the fund grows at 8% each year and pays out 5%

leaving 3% additional in the fund each year.

All

told, over the fifty years we have charted, your endowment gift of $20,000

will have distributed a total of $108,367 in annual distributions to WFSU and have grown to almost $76,000, continuing to provide needed

support. Of course, this is based on the assumptions we outlined in the

opening paragraph; that the fund grows at 8% each year and pays out 5%

leaving 3% additional in the fund each year.